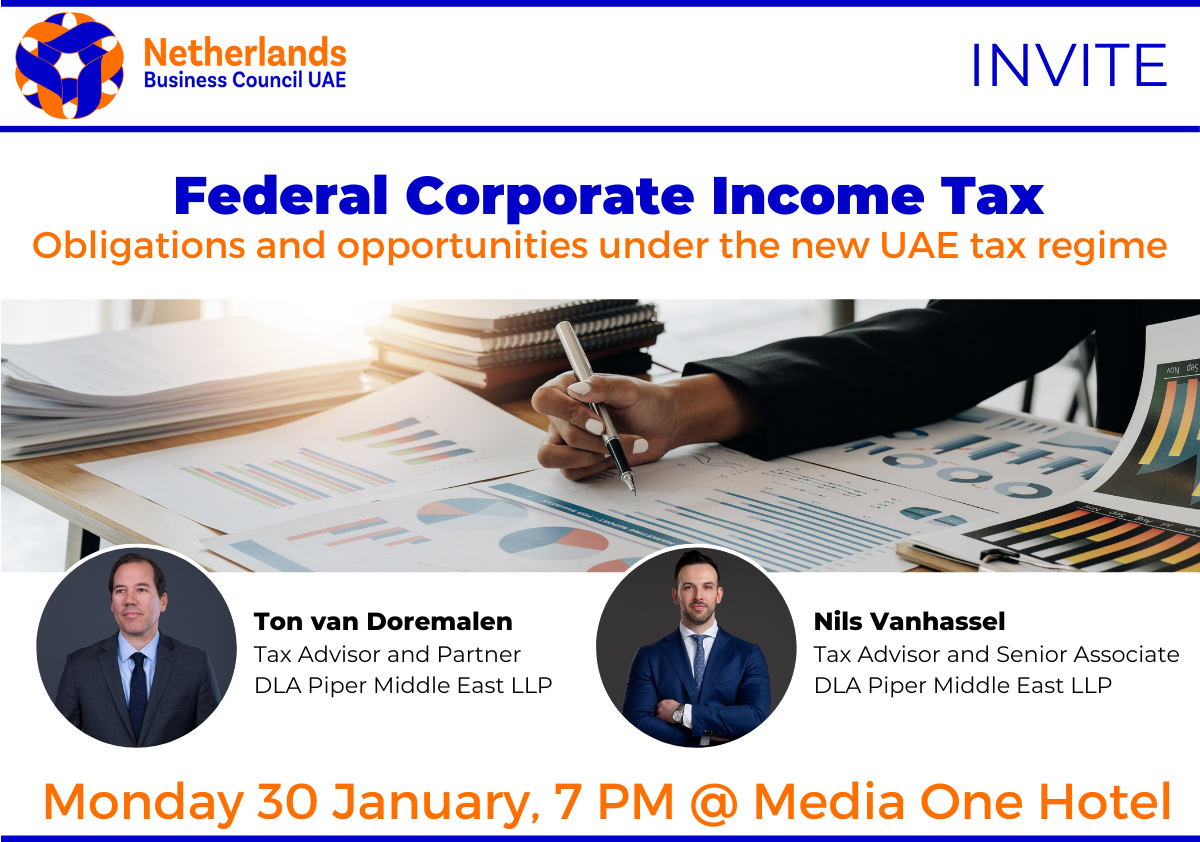

Federal Corporate Income Tax Monthly Networking Event

The Netherlands Business Council UAE, in partnership with DLA Piper Middle East, would like to invite you to our next Monthly Networking Event: Federal Corporate Income Tax, which will be held on Monday 30 January, from 7 PM onwards at the Media One Hotel, Dubai.

We are hosting this event to help both UAE Mainland and Free Zone businesses understand and learn more about the new Corporate Income Tax regime, that will be implemented in the United Arab Emirates in the near future.

After the presentation, we reserved plenty of time for a Q&A session. The official program will be followed by networking drinks, during which you will have the opportunity to engage and mingle with other members.

The Federal Corporate Income Tax Law

In January 2022, the UAE announced the introduction of a federal Corporate Income Tax (CIT) on business profits for the financial year starting on or after June 1, 2023. On December 9, the UAE published the CIT law, which forms the basis for the implementation of the country’s new tax regime. It is expected that detailed regulations related to the CIT regime will supplement the CIT law. The implementation of a federal CIT marks an important milestone in the country’s gradual evolution toward a mature tax jurisdiction.

Topics covered this evening:

- What are the main features of the CIT regime?

- What are the timelines for the implementation of CIT?

- Which types of businesses might be exempt from CIT?

- What are my obligations under the CIT regime as a Free Zone business?

- Which expenses will be deductible for tax purposes?

- What are the planning opportunities for businesses under the new CIT regime?

Speakers:

Ton Van Doremalen heads the Middle East tax group at DLA Piper. Ton advises both local and international clients in relation to operating their businesses, cross-border investments and activities in a tax efficient and compliant manner.

Nils Vanhassel is a Belgian tax lawyer and a member of the Brussels bar. He is a senior associate working within the Middle East tax team at DLA Piper, advising both multinational and local companies as well as (semi)government entities on complex tax matters.

(Provisional) Agenda:

7.30 PM Opening

7.35 PM Announcements and updates NBC

7.45 PM Speakers

8.30 PM Q&A

8.50 PM Closing words

9.00 PM Networking drinks

Date: Monday 30 January

Time: 7 PM - 9.30 PM

Venue: Media One Hotel

Fee: Free for NBC members

Registration fee includes 2 beverages, pass-around canapes, and valet parking.

Registration:

Kindly register on or before the 27th of January 2023, please register online or send RSVP to office@nlbcuae.com.

![]() Location: Media One Hotel

Location: Media One Hotel

Please be advised that photos, video and audio footage will be taken at this event. By entering the event premises, you give consent to the Netherlands Business Council UAE to photograph and video record your presence at the event, and its subsequent release, publication, exhibition, or reproduction to be used for news, promotional purposes, advertising, inclusion on websites, social media, or any other purpose by the Netherlands Business Council UAE and its partners. You release the Netherlands Business Council UAE, its employees, and every person involved from any liability connected with the taking, recording, digitizing, or publication and use of interviews, photographs, video and audio recordings. By entering the event premises, you waive all rights you may have to any claims for payment or royalties in connection with any use, exhibition, streaming, web-casting, televising, or other publication of these materials. You also waive any right to inspect or approve any photo, video, or audio recording taken by the Netherlands Business Council UAE or the person or entity designated to do so by the Netherlands Business Council UAE.